Investing is no longer just for the wealthy or financial experts. In 2025, with access to digital tools and platforms, anyone can start investing. even with a small amount. If you’re new to the world of investing, this blog will give you a step-by-step roadmap to get started safely and smartly.

Why Should You Start Investing?

Saving money is good, but saving alone won’t beat inflation. Your money needs to grow over time, and that’s where investing comes in. Whether you want to build wealth, buy a house, or secure your retirement—investing is the key.

Step 1: Set Your Financial Goals

Before investing, ask yourself:

-

Are you saving for the short term (1–3 years), medium term (3–5 years), or long term (5+ years)?

-

What are you investing for? (Home, retirement, child’s education, etc.)

This will help you decide where and how much to invest.

Step 2: Know the Investment Options in India

Here are a few beginner-friendly investment options:

1. Mutual Funds

-

Best for: Beginners who want diversification

-

Start with: SIPs (Systematic Investment Plans)

-

Minimum investment: ₹100–₹500/month

2. Public Provident Fund (PPF)

-

Government-backed, safe and long-term

-

Lock-in: 15 years

-

Tax benefits under Section 80C

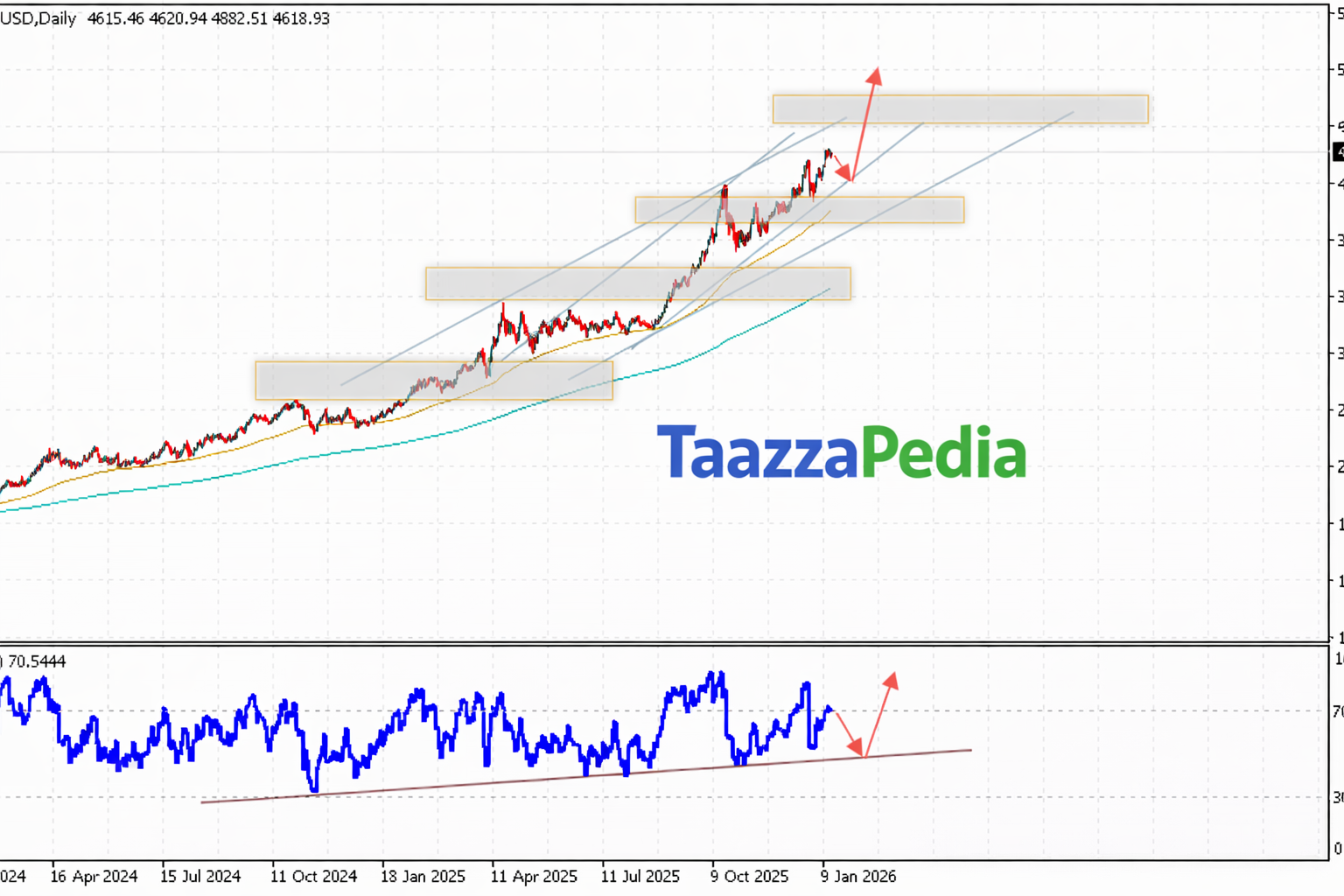

3. Stock Market

-

Best for: Higher returns, but high risk

-

Start with: Blue-chip stocks or index funds

-

Use apps like Zerodha, Groww, or Upstox

4. Fixed Deposits (FDs)

-

Low risk, fixed returns

-

Ideal for conservative investors

5. Gold (Digital Gold or Gold ETFs)

-

Good for portfolio diversification

Step 3: Open an Investment Account

To start investing in mutual funds or stocks:

-

Open a Demat account (Zerodha, Groww, Upstox, angelone)

-

Link your bank account

-

Complete KYC (Aadhaar, PAN)

It takes just a few minutes online!

Step 4: Learn Before You Invest

Don’t blindly follow tips from friends or social media. Learn the basics:

-

Watch finance YouTube channels

-

Follow SEBI-registered advisors

-

Read trusted finance blogs (like Taazapedia.com)

Final Words

Start small, stay consistent, and focus on long-term growth. Investing is not a get-rich-quick scheme—it’s a habit that builds wealth slowly and steadily. The best time to start investing was yesterday. The second-best time is today.